We give you access to a highly diversified portfolio with world-class money managers.

As stewards of the charitable funds entrusted to us, we are committed to growing your investments so that you can grant more to the communities and causes you care about. By pooling the resources of many donors, Berkshire Taconic gives you access to a highly diversified portfolio with world-class money managers that would not otherwise be available to individuals or many organizations on their own.

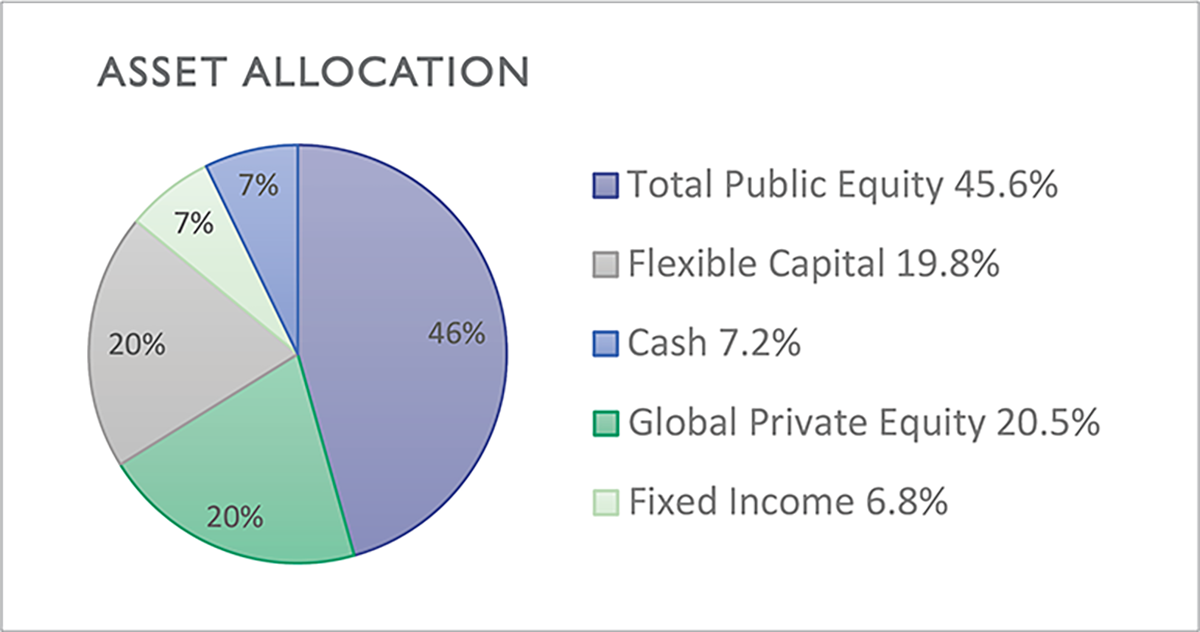

Our investment approach is designed to provide strong returns, with moderate risk, in order to maintain funds’ spending power over time and in varied market environments. For our Managed Pool, we use a well-diversified asset allocation that combines cost-effective ETFs (exchange- traded funds) with investments in flexible capital (hedge funds) and private equity to achieve higher returns per unit of risk or volatility. Fees paid to active managers are justified by higher returns, or we invest in index funds to minimize costs.

Investment Management

We value expertise, due diligence and collaboration in our investment program and utilize multiple levels of oversight to manage over $240 million* in assets.

- Our board of directors ensures a stable and effective investment program.

- Our investment committee of seasoned investment professionals runs the program. Each member has deep expertise in specific asset classes.

- The committee engages Prime Buchholz, an independent investment consultant, for due diligence and additional advice on asset allocation and investment strategies and managers.

Our professional staff brings broad knowledge of community foundation finance and investments to manage all transactions and accounting.

Together, we have consistently delivered superior results that maximize grantmaking and preserve and grow resources. View our our most recent return summaries. Learn About our Socially Responsible Pool

Investment Committee, Advisors, & Managers

BTCF's investment program is guided by a group of board (*) and community members with extensive experience in institutional investments who together provide a broad range of expertise in different asset classes and employ top investment managers in each class.

Appointed by the foundation's board of directors from its members and others in the community, the Investment Committee meets at least quarterly to set long-term strategy, review performance, rebalance the portfolio, meet with current and prospective managers, discuss market conditions, and establish overall manager-specific benchmarks.

Our Investment Committee is supported by the foundation's Vice President for Finance and Administration and advised by Prime Buchholz of Portsmouth, N.H. Prime Buchholz is one of the country’s most reputable investment consulting firms, and its experienced team works closely with community foundations, hospitals, schools, faith-based organizations and other clients.

Liz Hilpman serves as president and chief investment officer of Barlow Partners, an investment advisory firm in New York City she joined in 2001. Prior to joining Barlow, Liz was a vice president of investments at Commonfund; an investment manager with Global Asset Management; an investment officer working in the endowment community at Dartmouth College; and the director of Alternative Manager Research at Dubin & Swieca. She is a frequent speaker at hedge fund conferences on the subjects of asset allocation, manager selection and monitoring. She has served on a number of nonprofit boards, including Jacob’s Pillow Dance Festival and the Cary Institute, and in leadership roles on the investment committees of several nonprofit organizations, including as chair of the investment committee of the Maine Community Foundation. She has served on the BTCF investment committee as a community member since 2013. She holds a B.A. from the University of New Hampshire and resides part-time with her husband in Norfolk, Conn.

Carol Flaton is a former financial advisor with expertise in restructuring, risk management, and governance. She currently serves as an independent director for companies undergoing transformation and has recently served on the boards of Hornblower, Bed, Bath & Beyond, and Talen Energy Supply. Carol was a Managing Director at AlixPartners, specializing in restructurings and turnarounds. Prior to AlixPartners, she was a Managing Director at Lazard, where she advised debtors, creditors, and equity holders engaged in restructurings, debt exchanges, 363 sales, acquisitions, refinancings, and capital raises. Carol earned her B.S.B.A. from the University of Delaware and her M.B.A. from the IMD (International Institute of Management Development) in Lausanne, Switzerland. A resident of Sharon, Conn., she is an elected member of the town’s Board of Finance and serves on the board of NCLC (Northwest Connecticut Land Conservancy), the state’s largest land trust.

Thaddeus Gray was a managing director at Abbott Capital Management, LLC, a New York-based investment advisor focused exclusively on private equity, where he served as chief investment officer and a member of Abbott’s executive committee. He is currently the managing member of Prufrock Capital, LLC and a senior advisor to Private Equity Club, a Luxembourg-based fund of funds. Prior to this, Thad worked as syndicate manager/assistant vice president for Commerzbank Capital Markets Corporation and as an analyst in the Corporate Finance Department for Credit Commercial de France in Paris. He also serves as president of the board of managers of East Side Settlement House in New York. He has served as a community member of the Berkshire Taconic Investment Committee since March 2013 and on the BTCF board from 2015-2024. Thad, a native of Litchfield County, is a graduate of University of Pennsylvania and New York University Graduate School of Business Administration. He resides with his wife in Lakeville, Conn.

Ben Farkas is a partner of Hellman & Friedman, a private equity investment firm. Since joining H&F in 2006, Ben has specialized in the software, fintech, information services, and industrial technology sectors. He is currently Lead Director at Enverus and UKG (Ultimate Kronos Group). His past directorships include Ultimate Software, Getty Images, OpenLink Financial, and Sheridan Healthcare, and he was instrumental in the firm’s investment in SnapOne. Ben also dedicates his time to serving as a Director of Grameen America and is a member of the EforAll Berkshire Leadership Advisory Board. Prior to his role at H&F, Ben worked on venture capital and private equity investing with Bain Capital across London, Boston, and New York, and served as a management consultant with Bain & Company in Boston. Ben holds an M.B.A. from Harvard Business School, a B.S. from the Wharton School of Business and a B.A. from the College of Arts & Sciences at the University of Pennsylvania. Ben, his wife, and three sons have a residence in Berkshire county.

Seth Masters is an angel investor, advisor and mentor for early-stage companies that apply enabling technologies to solve real problems. He retired from AB Bernstein in 2017, where he served for 27 years as a leader of asset management businesses. As the chief investment officer of Bernstein Private Wealth Management, he oversaw portfolios worth more than $80 billion for over 25,000 clients. His previous roles at the firm included chief investment officer of asset allocation, chief investment officer of defined contribution, chief investment officer of blend strategies, and chief investment officer of emerging markets. Among his other responsibilities, he served as the president of the Bernstein mutual funds and the Bernstein Trust company. Before joining Bernstein, he worked for five years as a consultant at Booz Allen Hamilton. He sits on the board of the Columbia Land Conservancy. He previously served as a member of the board and the investment committee of the Wenner Gren Foundation, as well as Bennington College. He holds a bachelor’s degree from Princeton University and a master’s degree in economics from Oxford University. He has a residence in Columbia County.

John O’Brien served as a Managing Director at The Rock Creek Group until his retirement at the end of 2024. At Rock Creek John worked within the firm’s Emerging Market Equities business where he was responsible for external manager evaluation / selection, country allocation and client relationships. Prior to joining Rock Creek Mr. O’Brien was a Senior Portfolio Manager at AllianceBernstein in London where he managed portfolio construction and risk management for the firm’s $60bn Global Growth Equities strategies. Before this he was CEO of American Express Asset Management International in London - an institutional asset manager with over $30bn under management and nine investment and research offices around the world.

At American Express Mr. O’Brien was a senior leader of the firm’s Financial Institution’s Group and a Director on the Board of the American Express global mutual fund family as well as a Trustee of the company’s UK pension plan. Prior to this he worked for UBS and Nomura International - both in London - focusing on Pan-Asian equities. John holds an M. Phil. in International Relations from Cambridge University and a B.A. in History from Vassar College. John is a Board member and Treasurer of the Berkshire Opera Festival and he resides in North Canaan, Connecticut.

Daphne Richards serves as President and CIO of Ledge Harbor Management, a single-family office, as of its formation in September 2016. Previously Daphne worked at Bessemer Trust Company, New York, from 1999 to 2014, where she was a Managing Director, Head of Hedge Fund investments and Co-head of Bessemer’s $5 billion Alternative Investment Group. She was a member of the Investment Committees for Bessemer’s private equity/venture capital and real estate/real

assets programs, and Chair of the Hedge Fund Investment Committee. She also served as a member of Bessemer’s Investment Policy and Strategy Committee. Prior to Bessemer, Daphne held senior investment roles at Frank Russell Company, Union Bank of Switzerland and Credit Suisse. Daphne is an Independent Director of Cohen and Steers Mutual Funds. Daphne is a member of the Northeast Dutchess Fund advisory committee. She holds a B.A. from Georgetown University and has a residence in Stanfordville, N.Y.

Investing for Good Webinar

Learn how we invested and managed our funds for community impact in FY 2023.